do closed end funds have liquidity risk

That causes closed-end fund discount to net asset value to widen. Closed-end funds are required to send a written notice - called a 19 a notice - whenever distributions include a return of capital.

Investing In Closed End Funds Nuveen

If the CEF includes foreign market investments it will be exposed to the typical foreign market risks including currency political and economic risk.

. Their yields range from 632 on average for bond CEFs to 722 for the average stock CEF according to Lipper Inc. Although fund shares trade actively that doesnt affect the fund manager because no assets are flowing into or out of the portfolio. Investing in a closed-end fund that is selling at a premium is risky because it means the investors are paying more than the underlying assets are worth.

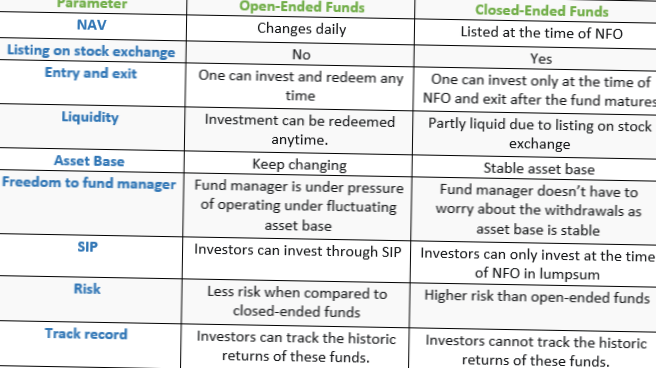

Since closed-end funds are a much smaller asset class than open-end mutual funds ETFs and stocks some of them have much less trading liquidity. With a closed-end fund the number of shares is fixed and shares are not redeemable from the fund. CEFs can also more easily borrow money against their asset base with the borrowing leading to financial leverage.

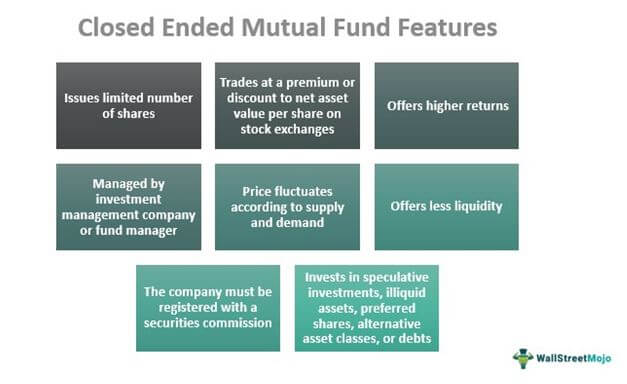

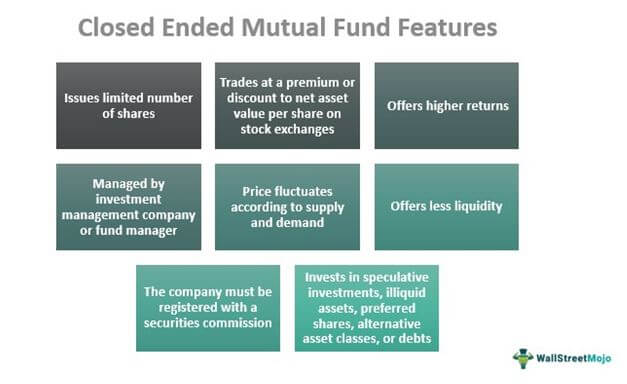

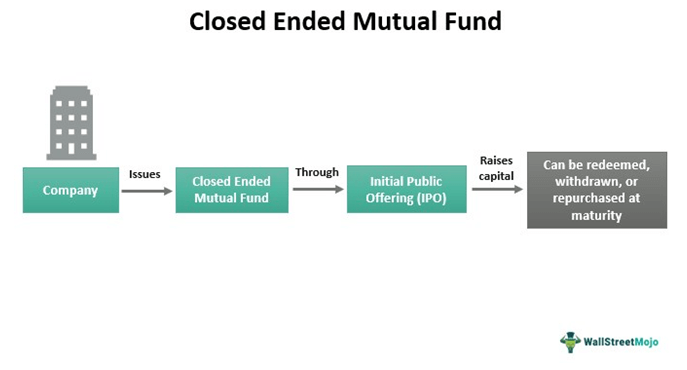

Closed-end funds have stood the test of time for more than a century and have the potential to help savvy investors. A closed-end fund is a type of mutual fund that issues a fixed number of shares through a single initial public offering IPO to raise capital for its. During down markets many of these investors want to sell their holdings.

Trades that are large relative to a funds average daily volume could have an impact on the market value. Unlisted closed-end funds also provide limited liquidity. CEFs are exposed to much of the same risk as other exchange traded products including liquidity risk on the secondary market credit risk concentration risk and discount risk.

Liquidity Risk Although CEFs are listed and traded on an exchange the degree of liquidity or ability to be bought and sold will vary significantly from one CEF to another based on various factors including but not limited to demand in the marketplace. There are many varieties of closed-end funds. Unlike open-end funds managers are not allowed to create new shares to meet demand from investors.

In other words it could be harder to buy and sell the stock at desirable prices depending on how many people are willing to take the other side of your trade. When investing in closed-end funds financial professionals and their investors should first consider the individuals financial objectives. Closed-end funds are traded on the open market.

The closed-end fund has the ability to go into less liquid because it doesnt have that 15 distinction. When the Investment Company Act was enacted it was understood that redeemability meant that an open-end fund had to have a liquid portfolio. It can load up on things that are less liquid and over time obviously using leverage which we havent talked about but those two things really really will drive higher return.

Funds or funds4 or closed-end upon which several of the Acts other provisions depend turns on whether the investment companys shareholders have the right to redeem their shares on demand. No assurance can be given that an active trading market will be available for any particular fund. Closed-end funds are considered a riskier choice because.

Secondly closed-end funds are less liquid than typical ETFs and have been bleeding assets for years. The shares have a stated liquidation value that the fund sponsor is required to redeem for cash or other assets at the stated maturity date. Because closed-end funds have a fixed asset base they can more easily buy illiquid investments investments that are traded less frequently or are difficult to quickly buy and sell.

The closed-end structure Mark Northway explains provides the manager with the benefit of permanent or long-term committed capital while. Each may have different investment objectives strategies and investment portfolios. Therefore closed-end fund managers can put capital to work in a long-term strategy without worrying whether their fund will have enough liquidity to pay back investors who suddenly sell redeem shares.

Closed-end funds CEFs can be one solution with yields averaging 673. Closed-end funds may trade above or below the funds net asset value based on supply and demand for the funds shares and other technical factors. On the surface theres a lot to like about closed end funds.

Closed-end funds issue only a set number of shares which then are traded on an exchange. The fact that a fund is listed on a stock exchange does not necessarily mean that sufficient liquidity will always be available. They typically each only have a few hundred million dollars of assets under management and dont trade that many shares throughout the day.

Most closed-end funds are owned by individual investors. Closed-End Funds and Liquidity Open-ended funds have no limit on the number of shares they can issue and capital flows into and out of the funds freely as new shares are issued and repurchased. Manzler 2004 shows that the discounts on closed-end funds are driven by both liquidity and liquidity risk differentials between the fund stocks and the stocks in the underlying portfolio.

They also can be subject to different risks volatility and fees and expenses. Closed-end funds CEFs can be one solution with yields averaging 673. Floating mandatory redeemable preferred shares represented 18 percent and fixed mandatory redeemable preferred shares represented 3 percent of all closed-end fund preferred share assets at year-end 2020.

They are retired when an investor sells them back.

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

Closed Vs Open Ended Funds Which One Do I Pick Mutual Funds Etfs Trading Q A By Zerodha All Your Queries On Trading And Markets Answered

What Are Mutual Funds 365 Financial Analyst

Understanding Types Of Mutual Funds

Guide To Closed End Funds Money For The Rest Of Us

5 Reasons To Use Closed End Funds In Your Portfolio Blackrock

The Problem With Open Ended Life Settlement Funds Articles Advisor Perspectives

What Is The Difference Between Closed And Open Ended Funds Quora

Closed Ended Mutual Fund Meaning Examples Pros Cons

Closed Ended Mutual Fund Meaning Examples Pros Cons

Closed End Fund Definition Examples How It Works

Open Ended Mutual Fund Vs Close Ended Mutual Fund What To Prefer

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

Difference Between Open Ended And Closed Ended Mutual Funds Differbetween

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends